Dreaming about your first home purchase but find it frustrating getting your offer accepted because your agent has told you it’s not good enough due to going FHA? The real estate industry is filled with inaccurate information and not all lenders are the same. The question we are always asked does it really make a difference going conventional vs FHA?

This article will give you an idea of how they differ and give you insight as to the truth behind does a conventional buyer have advantage over the FHA buyer.

What is an FHA loan?

An FHA loan is insured by the Federal Housing Administration. Lenient qualifications make it a good choice for those with lower credit scores and those with limited funds for the down payment. These loans are just as good as a conventional loan.

Credit Score Requirements

Lenders need to know your credit score no matter which loan option you choose.

FHA Loan

Credit scores as low as 500 may be eligible for an FHA loan as long as the borrower can afford a 10% down payment. However, if you have a credit score of 580 or higher, the down payment requirement is as low as 3.5%, and you’ll qualify for a more favorable interest rate.

Conventional Loan

Conventional loan lenders ordinarily require at least a 620 credit score to get you approved.

Down Payment Requirements

Let’s take a look at the down payment requirements for both loans.

FHA Loan

Homebuyers with a credit score between 500 and 579 must make a 10% down payment. Though, a 580 credit score allows for a down payment as low as 3.5%.

Conventional Loan

Conventional loans can require a down payment as low as 3%, contrary to the popular belief that 20% is necessary. However, this requirement varies from lender to lender. Most lenders require 20% down payment, however our conventional loans do not have mortgage insurance when you put 11% down. This could be hundreds to thousands of dollars in savings to the home buyer.

Debt to Income Requirements

Your DTI is the percentage of your monthly income that goes to debt payments, and it’s computed by dividing your total debt by your gross income.

FHA Loan

Like their lenient credit score terms, FHA loans also have more lenient DTI requirements. The maximum DTI for FHA loans is 57%. However, it may be lower in some cases.

Conventional Loan

There’s not a set DTI ratio for conventional loans as many but generally speaking, you’ll need a DTI of 50% or less. However, there are some situations where borrowers can still qualify with a DTI of up to 65%.

Loan Limits

FHA and conventional loans have loan limits that change yearly, based on whether home prices are up or down. For 2022, the maximum loan amount for an FHA and conventional loan is $970,800 in most parts in California.

What’s the main differences between FHA and conventional loans

Regardless of your credit, the main difference is based on the approval process the lender is using to approve your loan. This puts a lot of homebuyers at a disadvantage that is commonly overlooked regardless the type of loan you have. A good proven loan approval system will put a FHA buyer in the drivers seat over and above a conventional buyer all day long.

Guaranteed To Close On Time Loan Approval System

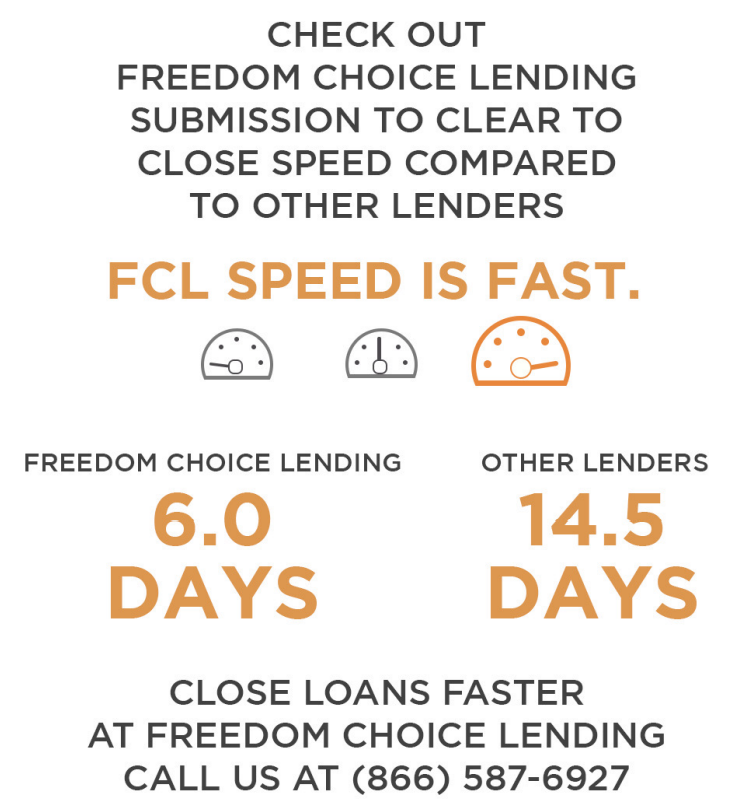

The fact is, both loans are great at helping home buyers purchase a home. Our FHA loans do come with a guarantee to close on time that gives our homebuyers a competitive advantage over other lenders including conventional loans. Faster turn times combined with our proven proprietary Guaranteed To Close On Time Loan Approval System provides home seller peace of mind in the event we cannot close on time. Just imagine if you were the home seller and you received multiple offers including conventional offers. All the conventional offers didn’t have a guaranteed approval letters by the loan underwriters and you received an FHA offer that was good as cash guaranteed by the underwriter, which offer would you accept?

You see there is good news for FHA homebuyers and you are not at a disadvantage. Our Guaranteed To Close On Time Loan Approval System has helped hundreds of buyers beat out other buyers including cash and conventional buyers by getting their offers accepted helping them buy their dream home. To start the home loan application process, contact David Delgado at 562-281-6163 or visit www.FreedomChoiceLending.com

David Delgado

CEO

NMLS # 351070

Office: 562-281-6163